Webinar Breakdown 00:50 Panelist Intros 16:15 Key trends in the sports investment landscape 22:10 What the consumer now wants vs what they previously wanted 25:00 Opportunities to fill these new needs within the consumer community 35:15 What’s the challenge for investors and owners nowadays? 38:30 How can players focus on setting their future and investing…

Fogel & Potamianos LLP Shares the Stage with SpaceWERX to Discuss the Future of Space and Business

Innovate to Accelerate (I2A): Fogel & Potamianos LLP Shares the Stage with SpaceWERX to Discuss the Future of Space and Business Innovate to Accelerate (I2A): Fogel & Potamianos LLP Shares the Stage with SpaceWERX to Discuss the Future of Space and Business Space really is the final frontier, and it is critically important to securing…

2024 M&A and Alternative Investment Forecast

Fogel & Potamianos LLP presents the 2024 M&A and Alternative Investment Forecast webinar, an all-star panel of hedge fund, venture capital, and investment banking experts contributing their insights and forecast for 2024…

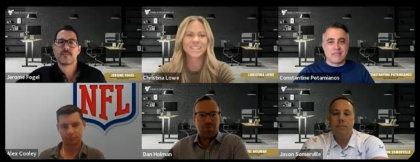

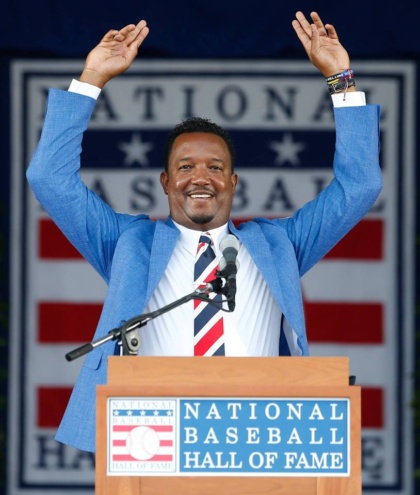

Competitive Capital: Investing in Sports and Sports Related Businesses

Fogel & Potamianos LLP presents Competitive Capital: Investing in Sports and Sports Related Businesses, an all-star panel from sports leagues and team ownership, sports private equity, investment banking, and law. Television producer and podcast host Christina Lowe will be moderating.

2023 M&A and Alternative Investment Forecast Webinar

Fogel & Potamianos LLP presents the 2023 M&A and Alternative Investment Forecast, an all-star panel of hedge fund, venture capital, and investment banking experts contributing their insights and forecast for 2023. Our executive director and podcast host Christina Lowe will be moderating.

Succeeding as a College Athlete in the New Era of NIL

Fogel & Potamianos LLP presents Succeeding as a College Athlete in the New Era of NIL, an all-star panel moderated by the one and only Christina Lowe. Experts from around the sports world will share their insights into how college athletes can become successful in the new world of NIL

Life After the Game

Fogel & Potamianos LLP presents Life After the Game, an all-star panel moderated by serial entrepreneur and radio and television personality Mark Hewlett. Experts from around the sports world will share their insights into post-playing opportunities for athletes.

Alternative Investments in a New World

Fogel & Potamianos LLP presents Alternative Investments in a New World, an all-star panel moderated by serial entrepreneur and radio and television personality Mark Hewlett. Experts from hedge and venture funds will share their insights into alternative investments.

The Silicon Valley Podcast

A Lawyer’s insights into Mergers and Acquisitions with Jerome Fogel

Negotiating NFTs for Athletes

SLA Member Submission “It’s better to be last to be good than first to be bad.” – David Hermann, social media expert While non-fungible tokens (“NFTs”) in the form of collectible digital artwork are a hot commodity, my advice is not to rush to ink the first deal put in front of your athlete client….

The Athlete of the Future

The Athlete of the Future Fogel & Potamianos LLP presents The Athlete of the Future, an all-star panel moderated by serial entrepreneur and radio and television personality Mark Hewlett. Experts from around the sports world will share their insight into what the athlete of the future will look like: Some of the topics that were…

Webinar 2021: State of M&A: Dealmaking in an Era of Uncertainty

Fogel & Potamianos LLP presents The State of M&A: Dealmaking in an Era of Uncertainty, an all-star panel moderated by serial entrepreneur and radio and television personality Mark Hewlett. We have experts in the fields of investment banking, private equity, and mergers and acquisitions will share their observations from the first half of 2021 and what to expect the rest of 2021 and beyond.

Webinar: 2021 Business Forecast

Our moderator Mark Hewlett is an entrepreneur to the core. Mark started with a t-shirt line when he was 15 and has had varied self-started businesses ranging from automated pool cleaners in South Africa to a large meat business in Zimbabwe. Having type 1 diabetes, he’s always been passionate about health and fitness and helped…

Webinar: Top 10 Things NOT to Do with Intellectual Property

“The greater danger for most of us lies not in setting our aim too high and falling short; but in setting our aim too low and achieving our mark.” – Michelangelo In this webinar, Robert Kramer our guest will cover how to strengthen your valuable IP assets by avoiding 10 costly mistakes with patents, trademarks,…

Webinar: The State of M&A – Dealmaking in the COVID Era

M&A for the foreseeable future falls in three segments: 1) thriving companies – e.g. direct to consumer brands, healthcare, technology, and essential services; 2) strong companies who have enough cash to weather the storm; and 3) companies that will become distressed target. In this webinar, we’ll cover: -Current state of M&A Activity-Bridging valuation and financing…

Webinar: Controlling the Uncontrollable

Panel Q&A 2:40 More about the Panelists 6:35 What is the entrepreneurial operating system? 10:05 What things should every company know in its different stages? 20:25 What types of changes should companies make to stay out of a crisis? 35:10 What does a good meeting look like and what does it need? 42:10 Why communication…

Webinar: Marketing During The Crisis

Hear from an insightful panel on how to solve marketing problems and make critical marketing decisions for your company during a crisis. Panel will include: Denise Roberson, Chief Purpose Officer of advertising agency TBWA\CHIAT\DAY which develops strategies for some of the world’s most iconic brands. Her work includes groundbreaking research and thoughts on the role of corporate purpose as…

Starting Right: M&A Preliminary Due Diligence

When making an acquisition, it’s important to perform preliminary due diligence as a buyer before making an offer or submitting an LOI. To start: Request financial statements, including corporate tax returns, for at least 3-5 years. Observe trends in cash flow, profit, expenses, and debt load, for example. Does the valuation make sense based on these…

Leadership Consulting: Why it’s the best investment for yourself and for your team.

As a leader, you are responsible for the vision and direction of your team. The higher your position, the more responsibility you have, and your leadership needs to meet the needs of your team and organization. Your leadership effectiveness is determined by the context in which you operate. For example, the CEO of Delta Airlines,…

Honored to Help Foster UT Austin Football Player Development – Go Longhorns!

This week, Constantine Potamianos was invited by Kevin Washington, Director of Player Development, to go talk to the University of Texas at Austin football team about what it takes to get a business successfully off the ground. This was part of UT’s commitment to exposing athletes to opportunities outside of sports and giving them the…

When does your startup business need a lawyer?

Entrepreneurs are adept at wearing many hats in their business, which can be a competitive advantage. However, this strength can become a weakness when you wait too long to bring in specialized assistance, which is certainly true when considering hiring a lawyer. But when is the right time?

3 Advantages of Having an Outside General Counsel

Many small and middle market companies may not have a General Counsel. Here are the advantages to having an outside general counsel on a fractional basis. 1. You will save money in the long run because you often spend 10 times or more what you save now.We have seen it time and time again. A…

Utilizing an Outsourced General Counsel: Bring Them In Early

We have a number of clients who call upon our firm as an outsourced general counsel. Typically an engagement begins on a project basis, and as we begin to learn more of the client’s business, we are brought in on more and more aspects of the business. What we find is that the earlier we…

Pitfalls of High Net-Worth Advisors

Building and guarding client assets is more than a full-time job for family offices, agents, consultants, and other financial advisers. It is key for them when advising clients to avoid these pitfalls: Allowing clients to invest in projects without proper due diligence:Film, restaurants, product development, and other ventures are a sample of opportunities that become…

Steps to Forming a Multi-Member LLC

We work with a number of entrepreneurs, companies, and visionaries. The goals and needs are different for each one of them. Yet there are a series of steps to take when forming a multi-member LLC: Step 1 Choosing the Right Entity Below is link to a short article that explains the different types of entities….

M&A Update: Rise of “Social Due Diligence” and the “Weinstein Clause”

In the midst of a flury of M&A activity, Bloomberg is reporting that buyers are requesting additional language in the representation and warranty provisions of company purchases to protect from the headline risk and drop in value of companies associated with sexual misconduct allegations. This provision is being termed the “Weinstein Clause.” How should you…

Negotiating the Sale of Your Company-Introduction to Earn-outs

You have put years of hard work, including restless nights, into your company. And now you have an offer to purchase your company (perhaps from an international corporation with operations here in US, or a US based company looking to expand their portfolio). You have been negotiating on price with the buyer and seem to…

Negotiating the Sale of Your Company: Earn-out Examples

As mentioned previously regarding earn-outs, these are common provisions that you will see from the buyer as a seller of your company as a way to compromise on the valuation. Let’s take a look at some examples: In 2014, Alcoa purchased aerospace jet engine component maker Firth Rixson for $2.85 Billion. This included $2.35 billion…

Negotiating the Sale of Your Company: Earn-outs When Staying on as an Employee

In the previous post regarding earn-outs, we went over examples of earn-out scenarios. In some instances, the buyer is not only acquiring the company, but the people to help operate the larger enterprise. Sellers may be asked to take key rolls within the buyer’s company post-sale. Let’s look at an example. In 2016, Sotheby’s acquired…

Negotiating the Sale of Your Company: Earn-outs When Executives Become Employees

Last post, we looked at an earn-out example from Sotheby’s in which the entire earn-out will be paid. Here we will look at another example, this time from Disney’s acquisition of Maker Studios in 2014, where key executives stayed on with Disney. Here we look to Disney’s 10K from 2015. On May 7, 2014, the…

M&A: Anatomy of a Successful Acquisition

There is something to be learned from successful M&A acquisitions. In contrast to an earn-out strategy, Let’s look at the timeline of Disney’s acquisition of BamTech, which began in 2016: Here, we look to Disney’s 2016 10-K In fiscal 2016, [Disney] acquired a 15% interest in BAMTech, LLC (BAMTech), an entity which holds Major League…